It’s tough to get an accurate and honest review of payment processors. We at TCM have been in the business of payment processing for well over a decade so we know all the credit card processing competitors, especially in Canada, including the good and the bad.

It’s never a black or white answer. It’s never 100% good or 100% bad. Therefore we’ll try to provide an open-minded review of Moneris because, like them or not, they are a major payment processor in Canada.

Moneris is a Canadian payment processor and acquirer that is based in Toronto. Being a payment processor and acquirer means that Moneris sells payment processing directly to merchants, underwrites their business to provide credit, and builds technology for credit card and debit card processing. You can read more about the value chain in our payments industry overview if you want to understand the types of companies involved in payments.

Moneris was founded the year 2000 as a 50/50 joint venture between the Royal Bank of Canada (RBC) and Bank of Montreal (BMO). Today, Moneris remains a private company. Being a company owned by large regulated financial institutions, Moneris may have a tendency to move slow and have some bureaucratic processes.

Moneris is the largest payment processor in Canada. Moneris processes more than 3 billion transactions a year and has over 350,000 merchant customers. Moneris has remained at roughly 350,000 customers for many years.

Although Moneris gets many new customers each day, it is estimated that they lose the same amount of customers each day which is why they stay at around 350,000 customers. There are around 1 million businesses that accept credit cards in Canada, therefore Moneris has around 35% market share. They are a big player.

Moneris has a good advantage because two of Canada’s largest banks, RBC and BMO, funnel customers to them. Anytime a business sets up a new bank account, they will bring in Moneris.

Moneris has around 1,900 employees with offices in Toronto ON, Sackville NB, Burnaby BC, Montreal QC, and Calgary AB.

Moneris offers a wide range of products including physical POS terminals, mobile payment products, and online payment services. The benefit of Moneris is that it has a wide range of products. That being said, there are many other payment processors and resellers that make it easy for merchants to get all the products they need.

Overall, Moneris products offer all the capabilities that merchants may need. However, there have been some complaints that there are multiple accounts you will need to have within Moneris products. For example, if you want to use their mobile product, MonerisGo, you will need a separate account for it.

The Moneris product development cycle can be seen as quite slow. This is not that different from most banks and bank-owned companies. Therefore don’t expect a lot of frequent iteration and evolution on their products.

One of the most complained about characteristics of Moneris is their pricing. Moneris pricing is not very transparent and expensive. The only pricing on their website is for their PAYD Pro pricing for their mobile product. Their mobile product is priced at $19.95 per month, plus 2.65% per transaction. In the fine print it states that fees are 2.85% + $0.15 for card-not-present transactions.

If you want any other products, you’ll need to talk to a sales person to understand the fees. Moneris fees is what you should definitely dig into and ensure you’re getting what you expect.

Reviews from customers state that Moneris has many early termination fees and locked-in contracts. If you try to leave early, we have heard that they will also charge equipment refurbishing fees. Some reviews have also pointed out that there are hidden feeds for processing. Lastly, you may expect price increases each year on your merchant account.

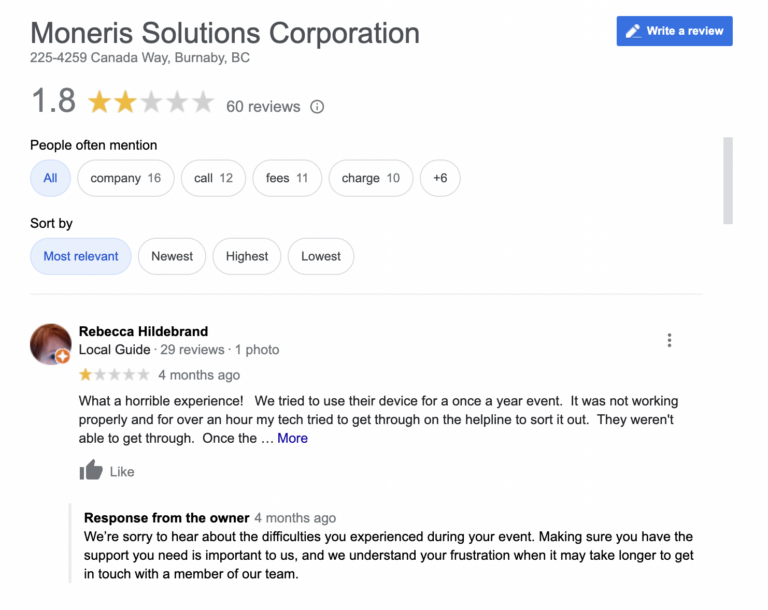

You can easily get a sense from customers by doing a Google search on “Moneris review”. If you view the online Google profile for Moneris, you’ll see a 1.8 out of 5 rating. This is very low. It’s easy to find a processor with a higher rating.

The most common complaints of Moneris are hidden fees, high termination fees and locked-in contracts, rates that get increased each year, and long wait lines for customer service. These are things that businesses should avoid. This is not to say that everyone has a poor experience.

If you watch your statements like a hawk and ensure you abide by Moneris’ contract, you might be fine. But, ensure you do your research first. TCM has made a commitment to offer the lowest fees with complete transparency. This is a key reason customers stay with TCM. We never have locked in contracts or termination fees.

Just because you are the biggest payment processor, it doesn’t mean you are the best. It is worthwhile to take a look at Moneris, however do your research. Read online reviews and make your own judgement call. If you want to go further into the details of how TCM differentiates itself, give us a call.

There is no shortage of competitors of Moneris. Payment processing is big business, so you have a massive range of credit card processing competition. The top Moneris competitors from our perspective include Square for small businesses, TCM for medium to large businesses, and Chase Paymentech for traditional enterprises. If you want more details, check out a full review of the best payment processors in Canada.

Contact us to get a true rate comparison for free. Let us help show the truth. Send us a recent statement and we’ll compare your current rates with what you would have with TCM. We’ll even help explain how to read your statement line by line if you like.

The steps to switch your payment processor is quite simple. First, verify your cancelation fees if any, the sign up for your new merchant account, then cancel your current payment processor.

In the end, the TCM mission is to drive down the cost of accepting payments. We aim to be the lowest cost provider. Period.

Copyright © 2025 TCM Inc. | Privacy Policy

TCM is a payment processor in Canada. The TCM name and logo are trademarks of TCM Inc payment processing in Vancouver, Canada. The Interac name and logo are trademarks of Interac Inc Canada. The Visa, MasterCard, and AMEX logos are trademarks of Visa International, MasterCard International Incorporated, and American Express Company. TCM is a Registered Partner/ISO of the Canadian Branch of U.S. Bank National Association.