The Durbin Amendment has reshaped the U.S. financial system since it began in 2010. Named after its chief advocate, Senator Richard Durbin, this legislative moved was designed to fix the increasing interchange fees charged by banks for debit card transactions. By limiting debit card fees, the amendment tried to make

Credit card processors (or merchant service providers) have exposure to losing the money. That’s the risk which merchant account providers take. By the way, here’s

New financial technology firm aims to drive down the cost of accepting payments for merchants and bring radical transparency to the payments space. FOR IMMEDIATE

A reserve on a merchant account in credit card processing is a temporary hold on a portion before they are deposited in your bank account.

Our goal is to increase your cash flow and your profitability. We increase your profitability by providing you the best rates. We increase your cash flow

What is radical transparency? When you start a company, an early decision you’ll want to make is how much information you are going to share

A merchant account is similar to a bank loan. It provides credit to a business. It is credit because after a customer swipes their credit

Reading credit card statements is complicated. There is no standard and there are no regulations enforcing a pricing method. There is a credit card processing

Getting good rates from a credit card processor is tough but not impossible. It can be complicated to understand your rates. Credit card processing has

You need to make sure you have good rates as a merchant. If you don’t have good credit card processing rates, it means less cash

RMTs (Registered Massage Therapists) and general massage therapists are in a competitive business. The core of a successful RMT is repeat business. When you have

First, just because a payment processor says they will get you 1.54% rates does not mean that is what you will pay. It’s unfortunate but

Accept credit cards with TCM and we’ll show you how much we make. We do that to keep us aligned with our mission which

If there is one point you should take from this article, it is that Interchange Plus pricing is by far the most merchant friendly pricing

Quite often, you need a payment processor. If you are accepting credit card or debit cards you will need a payment processor. If you also

It is unfortunate but sometimes there are issues in payments and credit card processing. They range from small annoyances to mission critical problems. Here’s some

Accepting credit cards cost money for a business. That is likely the the main reason a business might not want to accept credit cards. It

Interchange plus pricing, sometimes called cost plus, is one of the common ways that payment processors price their services for merchants. There are two other

There is a long history of retailers or financial institutions providing credit for customers. In the 1800s and early 1900s, imagine going into your local

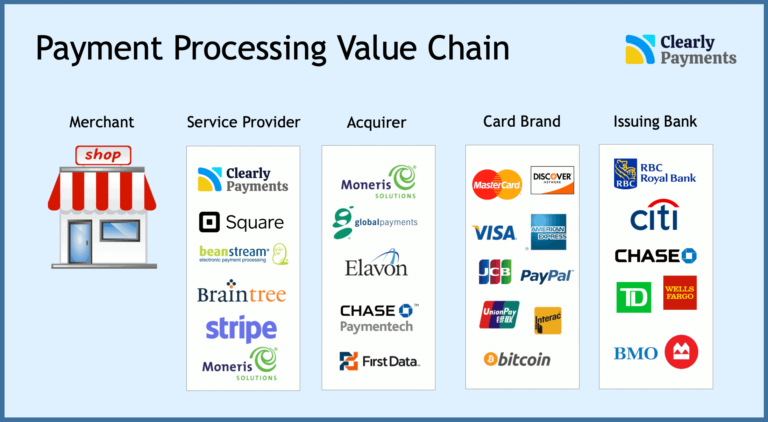

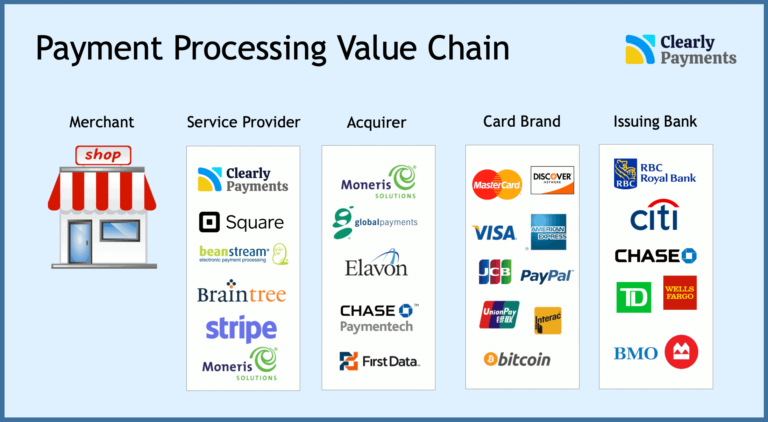

The payment processing industry is a sector of the financial industry that handles electronic payment transactions. It includes companies that provide payment processing services, such

It’s been a decade long trend. People are using cash less in favour of credit card and debit card payments. It’s a trend that will

Chargebacks can have negative implications for merchants. They result in financial losses as the revenue from the sale is lost along with associated fees. Dealing

Copyright © 2025 TCM Inc. | Privacy Policy

TCM is a payment processor in Canada. The TCM name and logo are trademarks of TCM Inc payment processing in Vancouver, Canada. The Interac name and logo are trademarks of Interac Inc Canada. The Visa, MasterCard, and AMEX logos are trademarks of Visa International, MasterCard International Incorporated, and American Express Company. TCM is a Registered Partner/ISO of the Canadian Branch of U.S. Bank National Association.