A virtual terminal is a web-based application that allows merchants and business owners to accept credit card payments using an internet browser on a computer, tablet, or mobile phone.

Rather than being a hardware payment terminal or credit card machine, a virtual terminal is a web-based payment terminal, hence virtual terminal.

Who is a virtual terminal best for?

A virtual terminal is a very flexible tool for taking payments. Many types of merchants will find them useful. One of the most common use cases is for merchants that take sales over the phone. A merchant can have the customer read their credit card number over the phone while the sales person types it into the virtual terminal.

Virtual terminals are not limited to phone sales. They are very commonly used in office buildings, service businesses, and many other businesses that do not have lineups of customers or many transactions per day.

How does a virtual terminal work?

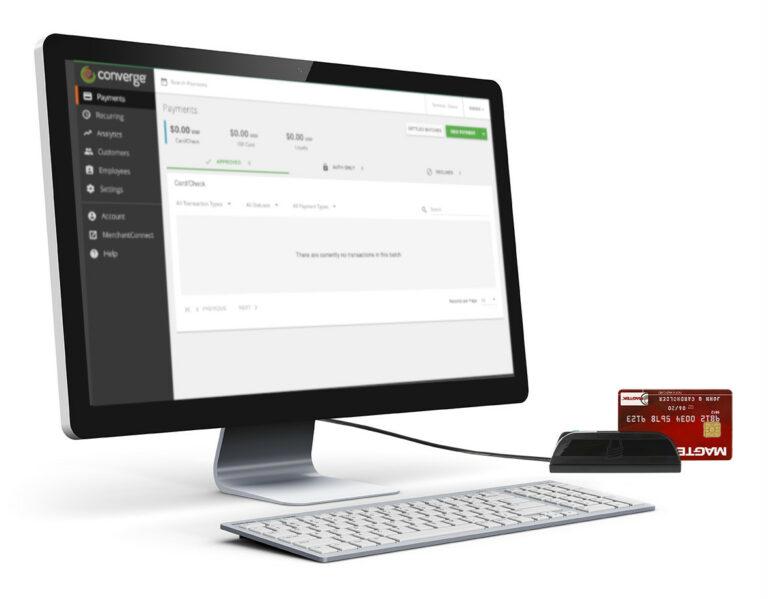

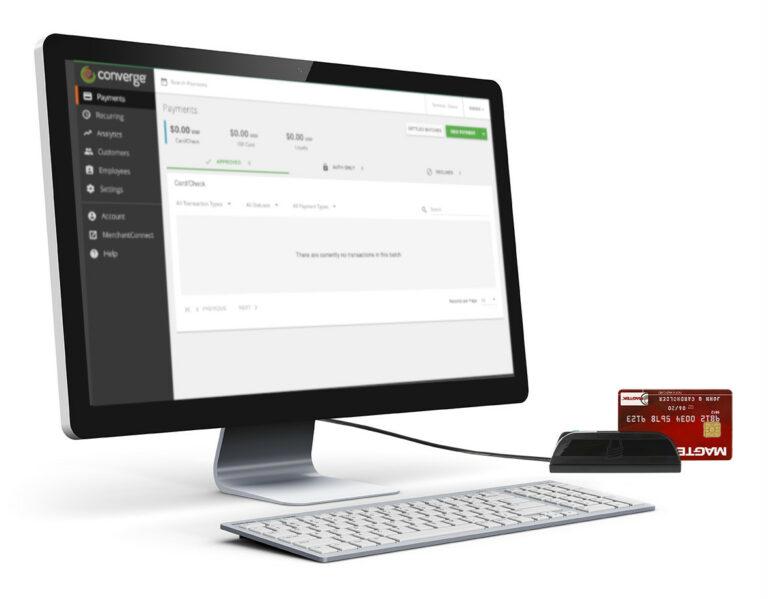

A virtual terminal generally comes included as a feature of a payment gateway. Once you have credentials for your payment gateway from your credit card processor, you can log in and access it. You can see an example of what a typical virtual terminal looks like below.

There is no special hardware needed for a virtual terminal. You can simply use your laptop, tablet, or computer to take credit card payments. You type in your customer’s credit card details along with the amount then submit the payment.

Once a payment is submitted, the payment gateway sends that transaction information to the payment processor for verification by the credit card network and the issuing bank. Once verified, the transaction will be approved and you will see the approval notification on the virtual terminal. All of this happens in seconds.

When customers are in front of you, fast payments means a great experience. There is an optional USB credit card swiper which you can plug directly into your computer. This means you swipe the credit card for fast and secure data entry. There is no need to manually enter credit card numbers if you don’t want to.

Some payment gateways support more features rather that single payments. Recurring payments, also known as subscription billing, is possible with certain virtual terminals. This allows you to enter a credit card to be charged multiple times over a period of time.

Recurring payments are common for membership programs or software as a service (SaaS) businesses. This allows you, for example, to charge a customer’s credit card every month for using your service.

What are the benefits of a virtual terminal?

The key benefit of a virtual terminal is the simplicity and speed to get up and running. You don’t need to deal with hardware or configuration. All you need is a merchant account then credentials to log into the payment gateway. Once you have that, you can start processing.

Another benefit is the portability of a virtual terminal. You can log into your terminal from any browser. You can even log into your virtual terminal from your mobile phone and take a payment when you’re on the road.