Credit card chargebacks are a common concern for merchants. They can impact your bottom line, reputation, and even your ability to accept credit card payments. As a result, understanding and managing your chargeback rate is vital.

What is considered a good credit card chargeback rate for merchants and how can you achieve it? In this article, we’ll explore these questions and offer guidance on chargeback rate management.

What is a chargeback?

A chargeback occurs when a cardholder disputes a transaction, resulting in the reversal of funds to the cardholder and a debit to the merchant’s account.

A customer initiates a chargeback by calling their credit card company (issuing bank) and giving a reason why a charge on their credit card should be reversed. The credit card issuers frequently support the consumer. Below is a chart on the most common reasons for chargebacks.

Chargebacks can be initiated for various reasons, such as unauthorized transactions, fraud, billing errors, or dissatisfaction with a product or service. Credit card companies allow chargebacks to protect consumers. Consumer protection is one of the key advantages of a credit card and is a primary reason they are so popular.

How merchants measure chargeback rate

The chargeback rate is a critical metric used to evaluate a merchant’s chargeback management. It represents the percentage of total transactions that result in chargebacks. The formula to calculate the chargeback rate is as follows:

Chargeback Rate (%) = (Number of Chargebacks / Total Transactions) x 100

For example, if a merchant has 9 chargebacks out of 1,000 transactions, the chargeback rate would be 0.9%.

A good chargeback rate for merchants

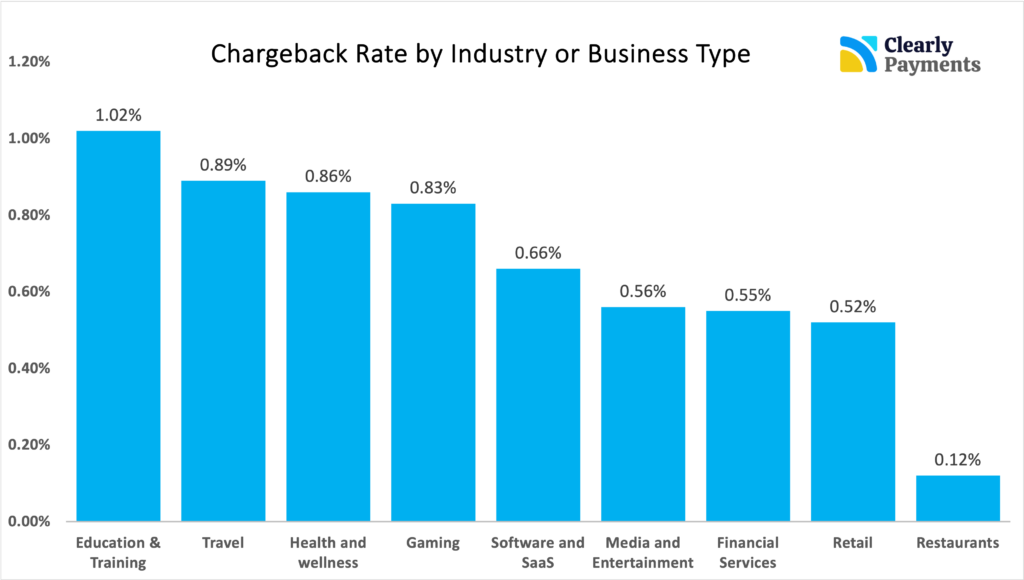

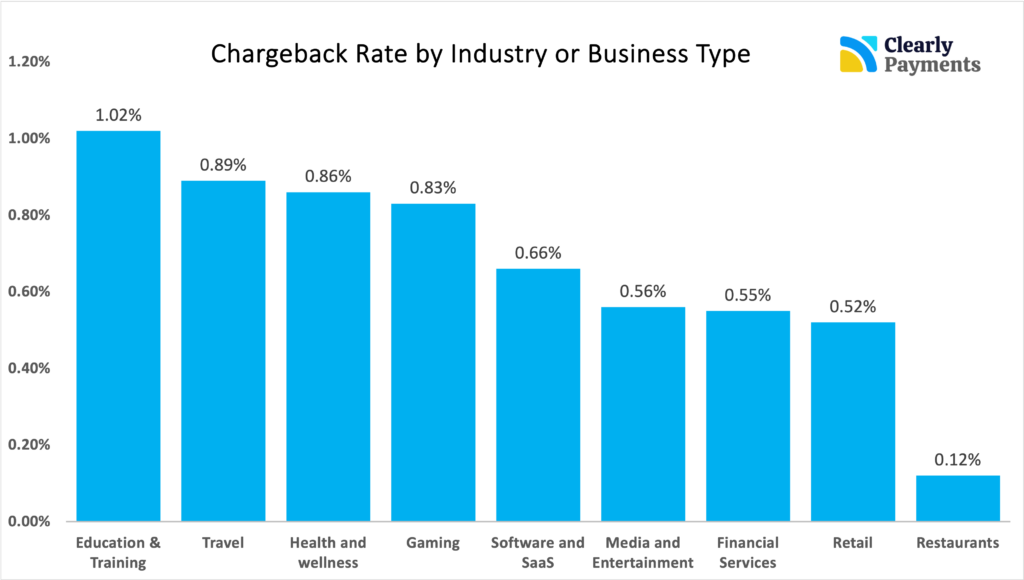

A universally accepted “good” chargeback rate for all merchants is difficult to determine, as the ideal rate varies by industry, business size, and risk factors. However, in general, an acceptable chargeback rate should fall below 1%. If a business is at or above 1% chargeback rate, they are typically considered high risk.

Businesses in high-risk industries might have slightly higher thresholds if they are in known industries. Payment networks, such as Visa and Mastercard, have their chargeback rate thresholds, and exceeding these thresholds can lead to penalties or restrictions.

It is commonly agreed in the payments and banking industry that an acceptable chargeback rate is below 1%. Businesses with lower chargeback rates are considered lower risk.

To determine an appropriate chargeback rate for your business, consider the following factors:

Industry: High-risk industries like travel or electronics may have a higher average chargeback rate due to increased fraud or disputes.

Business Model: Whether you operate online, in-store, or both can influence your chargeback risk. E-commerce businesses often face more chargebacks than traditional retailers.

Geographic Reach: Selling internationally can introduce additional risks, as different regions may have varying fraud rates and consumer behaviors.

Customer Service: Strong customer service and dispute resolution processes can help reduce chargebacks.

Product or Service Quality: Maintaining high-quality products and services can decrease the likelihood of customer dissatisfaction and disputes.

Fraud Prevention: Implementing robust fraud prevention measures can significantly reduce chargebacks.

For more information on chargeback rates, read the article on The Average Chargeback Rate.

How to manage and reduce chargebacks

While aiming for a low chargeback rate is essential, it’s equally important to implement strategies to manage and reduce chargebacks effectively:

Clearly Display Policies: Make your return, refund, and cancellation policies transparent to customers. Clear expectations can reduce disputes.

Strong Customer Service: Address customer inquiries and issues promptly and professionally.

Fraud Prevention Tools: Employ fraud detection and prevention tools to flag potentially suspicious transactions.

Secure Payment Processing: Ensure your payment processing is secure and compliant with industry standards.

Transaction Descriptors: Use recognizable transaction descriptors on customers’ statements to reduce confusion.

Data Collection and Analysis: Monitor transaction data to identify trends or patterns that may indicate potential issues.

Dispute Resolution: Actively work to resolve disputes in favor of the customer whenever possible.

Chargeback Alerts: Sign up for chargeback alerts to be notified of potential chargebacks in advance, giving you an opportunity to respond.

Stay Informed: Keep up-to-date with industry regulations and best practices in chargeback management.

TCM helps you with chargebacks

TCM is more than just a payment processor; it’s a valuable partner for businesses looking to mitigate the impact of chargebacks. With advanced fraud detection tools, TCM proactively identifies potentially fraudulent transactions to prevent chargebacks before they happen. They also offer a chargeback alerts service, providing notifications to merchants, enabling them to respond swiftly to potential issues and resolve disputes before they escalate into costly chargebacks.

In addition to robust fraud prevention measures, TCM provides dedicated support for dispute resolution, helping businesses with evidence and documentation to build a case against unwarranted chargebacks. By partnering with TCM, businesses can access a wealth of educational resources and expertise to better understand, manage, and prevent chargebacks, safeguarding their revenue and reputation in the process.