Credit card networks, like Visa and MasterCard, play an essential role in enabling millions of people to make digital payments across the world. Credit card networks are complex systems that facilitate transactions between merchants, credit card issuers, and cardholders. In this article, we will explore the workings of credit card networks, their history, and the major players in the industry. You can also read our overview of the payments industry.

What are Credit Card Networks?

Credit card networks refer to the financial systems that enable consumers to make purchases using their credit cards. They act as intermediaries between merchants, credit card issuing banks, and cardholders. Credit card networks provide the infrastructure and technology necessary to process credit card payments. They play a critical role in enabling the widespread adoption of credit cards as a convenient and secure form of payment.

The major credit card networks include Visa, Mastercard, American Express, and Discover. These networks process billions of transactions every year, generating billions of dollars in revenue. They also offer additional services, such as fraud protection and dispute resolution, to consumers and merchants.

Market share of credit card networks

Visa and Mastercard continue to dominate the market. As of September 2022, Visa and Mastercard together account for nearly 80% of the credit card network market share in the United States. While their market share percentages have shifted slightly over time, they have remained the top two players in the industry. Visa has approximately 53% of the market while MasterCard has 26% market share.

In recent years, American Express has been steadily increasing its market share in the United States. As of September 2022, it holds about 19% of the market share, up from around 15% in 2016. This growth has been driven by several factors, including strategic partnerships with merchants and an expanded portfolio of credit card products.

Discover has held a relatively small share of the credit card network market in the United States for many years, and as of September 2022, it holds about 3% of the market share. While the company has made efforts to expand its reach through partnerships with other companies, its market share has remained fairly consistent.

There are numerous other credit cards, but they hold a very small percentage of the market. Additionally, there are some differences regionally such as China Union Pay which has a 90% market share in China.

How do Credit Card Networks Work?

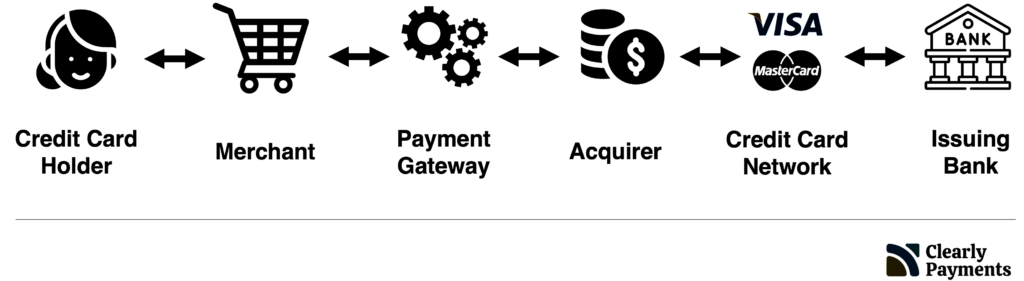

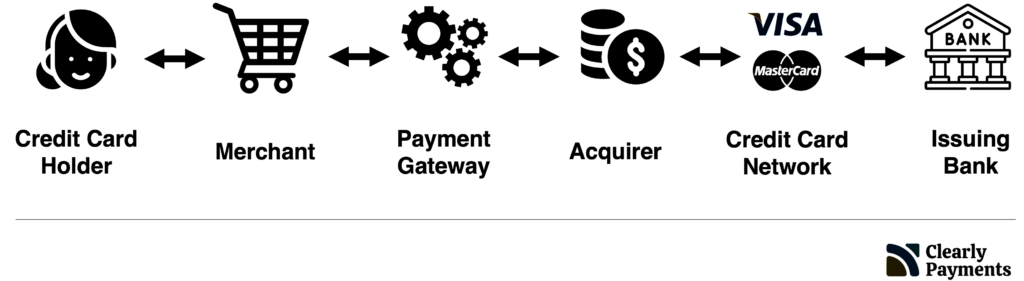

When a consumer uses a credit card to make a purchase, the transaction goes through a series of steps, each of which involves a different player in the credit card network. The following are the steps involved in a typical credit card transaction:

Step 1: The Credit Card Holder (Consumer) Makes a Purchase

The transaction begins when the consumer uses their credit card to make a purchase. The consumer swipes their card, inserts it into a chip reader, or enters the card details online or over the phone.

Step 2: The Merchant Sends the Transaction Details to their Acquiring Bank

The merchant sends the transaction details to their acquiring bank. The acquiring bank is the bank that the merchant has a relationship with, and it is responsible for processing the transaction on behalf of the merchant.

Step 3: The Acquiring Bank Sends the Transaction to the Credit Card Network

The acquiring bank sends the transaction details to the credit card network. The credit card network processes the transaction details and routes the payment authorization request to the issuing bank.

Step 4: The Issuing Bank Approves or Declines the Transaction

The issuing bank, which is the bank that issued the credit card to the consumer, receives the payment authorization request from the credit card network. The issuing bank checks the available credit balance, account status, and other factors before approving or declining the transaction. If the transaction is approved, the issuing bank sends an authorization code to the credit card network.

Step 5: The Credit Card Network Sends the Authorization to the Acquiring Bank

The credit card network sends the authorization code to the acquiring bank, which then sends it to the merchant’s point-of-sale terminal or payment gateway.

Step 6: The Merchant Completes the Transaction

The merchant completes the transaction by submitting the authorization code and the transaction details to their acquiring bank. The acquiring bank then settles the transaction by depositing the funds into the merchant’s account.

Step 7: The Issuing Bank Sends the Bill to the Consumer

The issuing bank sends the credit card bill to the consumer, which includes the amount of the transaction, any interest charges, and fees.

Credit Card Network Revenue and Fees

Credit card networks generate revenue by charging fees to merchants and credit card issuers. These fees include interchange fees, assessment fees, and other charges. Interchange fees are charged to the acquiring bank by the credit card network every time a transaction is processed. Assessment fees are charged by the credit card network based on a percentage of the transaction amount. You can read our overview of interchange fees and how they work.

The fees charged by credit card networks can vary depending on the type of card, the merchant’s industry, and other factors. For example, transactions involving premium credit cards may attract higher interchange fees than those involving standard credit cards. Merchants in industries that are deemed to be high-risk may also face higher. In the end, the merchants pay the payment processing fees which are generally in the 2.3% range. Read more about the average interchange rate that merchants pay.