In today’s digital age, governments at various levels face the challenge of efficiently managing payment processing for a multitude of services, including taxes, fines, licenses, permits, and more. With the increasing demand for convenient and secure payment options, governments need reliable partners who can provide robust payment processing solutions.

TCM is not only a payment processor but also a prominent provider of comprehensive payment solutions for the government sector. Our approach combines consultative services and cutting-edge technologies to revolutionize the payment experience for our public sector clients and their constituents.

Benefits of government accepting credit cards

Accepting credit cards offers numerous benefits to governments. Firstly, it enables them to expand their revenue streams by accommodating citizens who may not have immediate access to funds but can still make payments using their credit cards. This helps governments collect payments that might have otherwise been delayed or missed. Additionally, credit card acceptance provides convenience to citizens by offering a widely used and familiar payment method. Whether it’s online, over the phone, or in person, citizens can easily make payments using their credit cards, saving them time and effort compared to traditional payment methods like cash or checks.

Furthermore, credit card transactions are processed quickly, allowing governments to receive payments promptly. This improves cash flow and reduces the time and resources required for manual processing and reconciliation of payments. The potential for improved collection rates is another advantage, as governments can set up automated recurring payments, making it easier for citizens to stay current on their obligations. Moreover, credit card payments provide a traceable record of transactions, simplifying tracking and reconciliation processes.

Security is a paramount concern for governments, and credit card transactions offer encryption and fraud protection measures that mitigate the risk of fraud or unauthorized access to sensitive financial information. Compared to handling cash or checks, credit card acceptance provides a higher level of security. Administratively, accepting credit cards streamlines processes by integrating with existing financial systems, reducing manual data entry, and facilitating reconciliation and reporting.

In terms of citizen satisfaction, offering credit card payment options enhances the overall experience and convenience for citizens. It contributes to a positive interaction with the government and improves satisfaction levels. Additionally, credit card payments promote financial transparency and accountability by providing a transparent and auditable trail of transactions. Governments can easily track and report payment data, ensuring better financial management and oversight.

Credit card acceptance is also beneficial for governments in tourist destinations or dealing with non-resident individuals or businesses. It allows tourists and non-residents to make payments easily using their credit cards, eliminating the need for local currency or alternative payment methods. While credit card processing fees exist, governments can potentially realize cost savings by reducing the need for manual handling and processing of cash and checks. Automation and streamlined processes lead to more efficient resource utilization and cost reductions over time.

Specific needs of governments in payments

Governments have unique needs when it comes to payment processing due to the scale, complexity, and security requirements of their operations. Here are some specific needs of governments in payment processing:

- Security: Governments handle sensitive financial information and need robust security measures to protect against fraud, data breaches, and unauthorized access. Strong encryption, secure data storage, and compliance with industry standards such as PCI DSS (Payment Card Industry Data Security Standard) are essential. In addition, many governments may require level 3 payment processing, which brings more data within each transaction for enhanced operations and security. This is described in more detail below.

- Compliance: Governments are subject to various regulations and compliance requirements, such as financial transparency, anti-money laundering (AML), and Know Your Customer (KYC) regulations. Payment processors must adhere to these regulations and provide necessary documentation and reporting capabilities.

- Scalability: Governments handle a high volume of transactions, including tax payments, licenses, permits, fines, and more. Payment processing systems must be capable of handling large transaction volumes efficiently without interruptions or delays.

- Multi-channel support: Governments interact with citizens through multiple channels, including online portals, mobile applications, in-person counters, and call centers. Payment processors need to support seamless integration across these channels, ensuring consistent experiences and access to payment options.

- Flexibility: Governments often have diverse payment requirements to cater to citizens’ preferences. Payment processors need to support various payment methods such as credit cards, debit cards, bank transfers, PAD or direct debit payments, mobile wallets, and electronic funds transfers (EFT), accommodating different payment preferences.

- Integration with existing systems: Government agencies typically have complex legacy systems and software solutions in place. Payment processors should offer integration capabilities with these systems to streamline processes, avoid data duplication, and ensure accurate record-keeping.

- Reporting and reconciliation: Governments require detailed transaction reports, financial reconciliation, and auditing capabilities. Payment processors should provide robust reporting tools and enable easy reconciliation with financial systems, ensuring transparency and accountability.

- Accessibility and inclusivity: Governments strive to provide equal access to services for all citizens, including those with disabilities. Payment processors should comply with accessibility guidelines, ensuring their platforms are usable by individuals with visual, auditory, or motor impairments.

- Cost-effectiveness: Governments aim to optimize costs associated with payment processing. They may seek competitive pricing models, transparent fee structures, and opportunities for cost savings, especially for high-volume transactions.

- Disaster recovery and business continuity: Governments need payment processing systems with robust disaster recovery plans and redundancy measures. Continuity of operations is crucial to ensure uninterrupted service, even during emergencies or system failures.

It’s important to note that specific payment processing needs may vary depending on the country, government agency, and the services they provide.

Level 3 payment processing for governments

Level 3 payment processing can be advantageous for certain government entities that engage in high-volume or large-scale transactions with vendors or suppliers. This type of processing involves transmitting detailed line-item data along with payment transactions, providing more comprehensive information than standard payment processing. Governments can benefit from level 3 processing in several ways.

First, it can lead to cost savings by accessing lower interchange rates, which are often available for transactions that include detailed line-item data such as product descriptions, quantities, and prices. By capturing and transmitting this additional information, governments may qualify for reduced transaction fees, resulting in potential cost savings over time.

Additionally, level 3 processing offers enhanced reporting and tracking capabilities. The availability of detailed transaction data allows for better visibility into expenditures, vendor performance, and compliance monitoring. This supports effective financial management and decision-making within government agencies.

Level 3 processing also promotes transparency and accountability in government transactions. By capturing line-item data, it enables stakeholders to gain a clearer understanding of the goods and services purchased, ensuring adherence to procurement policies and reducing the risk of fraudulent activities.

Lastly, some government agencies may have specific compliance requirements or regulations that necessitate the use of level 3 payment processing. Adhering to level 3 processing standards ensures compliance and efficient data management.

Common ways governments accepts credit cards

Governments typically use several options for accepting credit cards. By offering a variety of payment options, government agencies can make it easier for clients to pay for their services using their preferred method of payment. This can improve the overall experience and lead to stronger relationships, as well as faster and more efficient payment processing for the governments. Here are some of the most common methods that are used to accept credit cards or debit cards.

Credit card machines

Credit card machines, also known as point-of-sale (POS) terminals or card terminals, are electronic devices designed to process credit and debit card payments in physical retail environments. These machines consist of various components that enable merchants to accept card payments from customers. These payment terminals accept credit cards and debit cards with swipe, tap, smartphone payments, and chip and PIN.

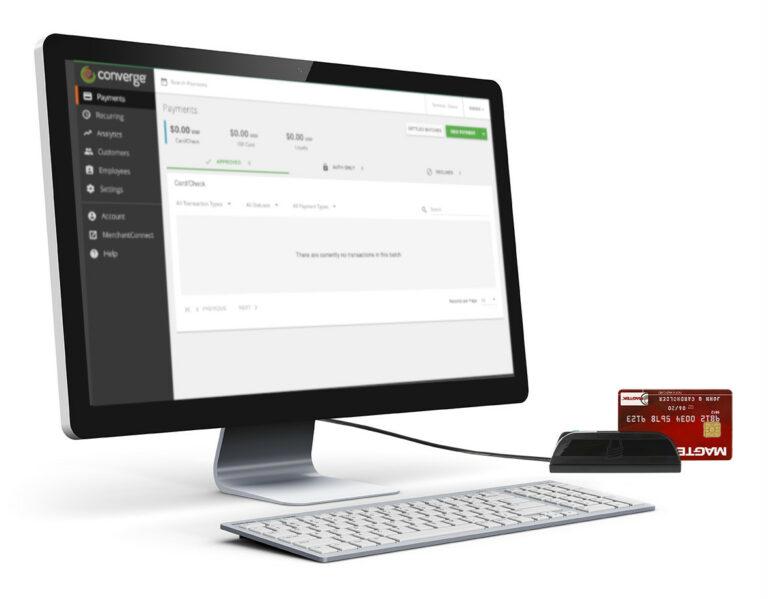

Virtual terminals

Virtual terminals are online payment processing systems that allow businesses to accept credit and debit card payments without the need for physical card terminals or hardware. They are web-based applications that function as a virtual point of sale (POS) for card-not-present transactions, typically used for mail order, telephone order (MOTO), or online payments. Essentially, you can turn any computer or internet browser into a payment terminal.

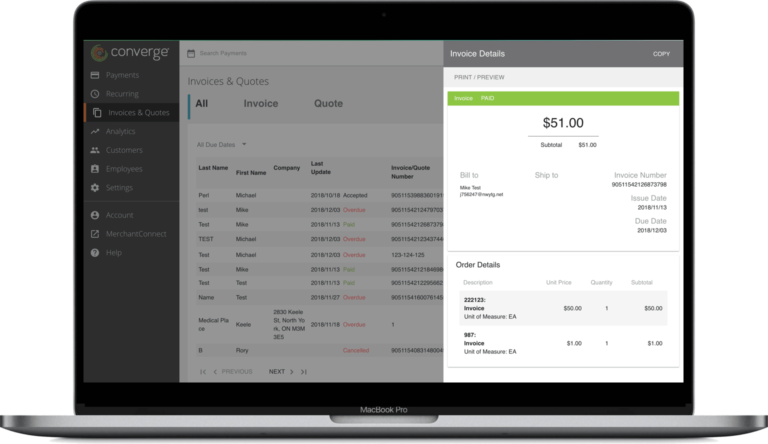

Email invoicing

Email invoicing is a method of sending invoices to customers electronically via email instead of using traditional paper-based invoicing methods. With email invoicing, businesses can generate digital invoices in various formats, such as PDF or HTML, and send them directly to their customers’ email addresses.

Online payments

Online payments refer to the electronic transfer of funds over the internet, allowing individuals and businesses to make or receive payments for goods and services. It involves the use of digital platforms, websites, or applications to initiate, authorize, and process financial transactions.

Hosted payment pages

Hosted payment pages, also known as payment checkout pages, are secure web pages provided by payment processors. These pages serve as an intermediary between the a government website and the payment network, facilitating the secure processing of online payments. This is one of the easiest and fastest ways to get payment processing set up.

Getting started with TCM

TCM stands out as a leading payment provider dedicated to supporting governments in streamlining payment processing. By offering advanced technology, tailored solutions, enhanced security, flexible payment options, seamless integration, and exceptional customer support, TCM empowers governments to efficiently handle their payment operations.

With TCM, governments can enhance their services, improve citizen satisfaction, and optimize financial management. TCM is a valuable ally in the digital transformation of government payment processing, helping to build a more efficient and citizen-centric public sector.

Get the best credit card processing for governments

- Lowest-cost processing in the industry

- Fund transfers in less than one day

- A full set of payment products to accept payment anytime, anywhere

- World-class customer service