Many accounting firms accept credit cards as a form of payment. They have found that it makes it easier for customers, it speeds up collections, and it helps with reconciliation.

Larger accounting firms have been more likely to accept credit cards as they have the resources and infrastructure to manage credit card payments securely and efficiently. Smaller firms have been more hesitant to accept credit cards due to concerns about the cost of processing fees. However, since 2020, the majority of accounting firms, both big and small, have started to accept credit cards.

Benefits of accepting credit cards for accountants

There are numerous benefits to accountants for accepting credit cards. Credit card processing enhances cash flow by speeding up collections for law firms. Law firms typically bill clients for their services and wait for payment, which can take weeks or even months. This delay can affect the firm’s cash flow, making it difficult to pay salaries, rent, and other expenses. TCM deposit credit card transactions in about one day, which is faster than most in the industry.

Secondly, credit card processing offers convenience and flexibility to clients. Clients expect to pay for accounting services using their preferred payment method and credit card processing allows them to do so. This convenience can improve the client experience, leading to better relationships and more repeat business.

Thirdly, credit card processing is secure and compliant. Law firms deal with sensitive client information and must adhere to strict data privacy laws. Credit card processing offers secure payment gateways that comply with industry regulations, ensuring that client data is protected.

Accounting firms must be aware of the costs associated with credit card processing. Processing fees charged by providers can vary, and law firms should compare different providers’ rates and terms to choose the most affordable option. TCM aims to offer the lowest payment processing fees in the industry.

How accounting firms accept credit cards

There are several common ways that the accounting industry accepts credit cards. Payments are typically accepted by credit card machine, a virtual terminal, email invoicing, or a hosted payment page which are described below.

Hosted payment page for accounting firms

A hosted payment page is the easiest way to accept credit cards on your website. It is a payment page hosted by TCM, which allows your customers to pay for their services on your website. They are secure, easy to set up, and have a great customer experience.

In a hosted payment page, the customer clicks a “Pay Invoice” link on your website. They are redirected to a secure checkout page hosted by TCM with your branding. The customer then inputs their credit card data and other information. It’s that simple.

Credit card machines in the accounting industry

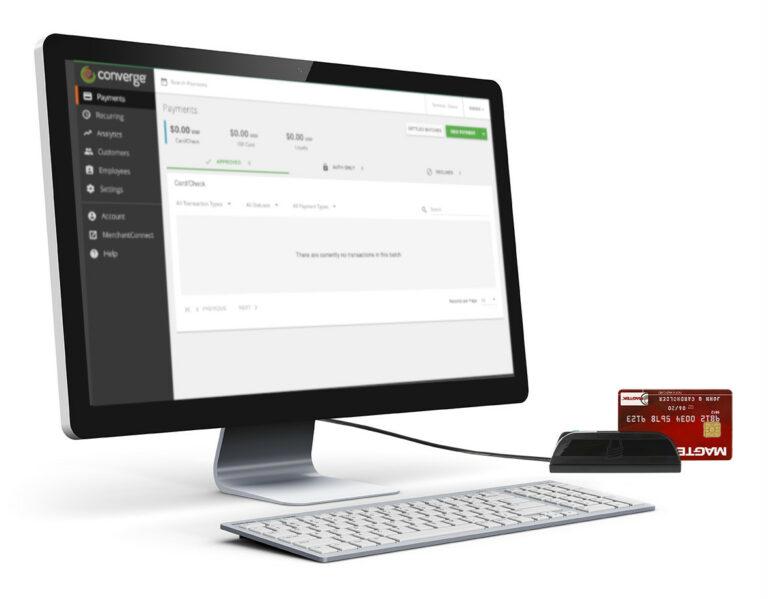

A virtual terminal is a software application that allows users to access a remote computer or server through a network or the internet. It simulates the functionality of a physical terminal, allowing users to input commands and receive output from the remote system.

A credit card machine, also known as a payment terminal, is the most popular way to accept payments at accounting firms. They are either mobile with no wires for connection or they can come as a countertop terminal. A key overall benefit of a credit card machine is that they also accept debit cards. TCM has a full selection of payment terminals.

Virtual terminals for accounting firms

A virtual terminal is a web-based application that acts like a physical terminal, allowing accountants to take payments using an internet browser or mobile phone.

A virtual terminal makes it easy to take credit card payments over the phone or in person. They are very commonly used in office buildings, service businesses, and many other businesses that do not have long lineups of customers or hundreds of transactions per day.

Many accounting firms use electronic invoicing. You can create invoices through a guided online invoicing tool. This creates a digital invoice and it is emailed to the customer which they can click a “pay now” button.

Email invoicing makes it easier to get paid by your customers. There are no more follow-up phone calls and emails. The TCM invoicing and quoting system does it for you.

The way fees work in payment processing

When it comes to payment processing, there are various types of fees involved. TCM has a mission to provide the lowest payment processing fees in the industry. That’s why so many businesses are moving to TCM.

Overall, fees are generally around 2.2% and $0.10 per transaction. You can take a look at the full pricing sheet here. Here is a breakdown of the fees within the cost of payment processing.

Interchange fees: These are fees charged by the credit card networks (e.g., Visa, Mastercard) to the merchant’s bank for processing a transaction. Interchange fees vary depending on the type of card used, the transaction amount, and other factors. They average around 1.81%

Processing fees: These are fees charged by the payment processor to the merchant for processing the transaction. Processing fees may be a flat rate per transaction or a percentage of the transaction amount, and they may include various fees (e.g., authorization fees, card brand fees, batch fees). This is roughly 0.45%.

Setup or monthly fees: Some payment processors may charge setup or monthly fees in addition to the fees mentioned above. This is roughly $10 to $15 per month.

You may also want to consider passing on some or all of these fees to customers by adding a surcharge or convenience fee to credit card transactions.

How accountants can start accepting credit cards?

Ultimately, whether or not to accept credit cards as a payment method is a business decision that depends on your specific circumstances and preferences. It’s worth weighing the pros and cons carefully to determine what’s best for your practice.

Accepting credit cards can make things a lot easier for both the accounting firm and the customer. Accepting credit cards can increase sales, streamline payment processes, and build customer loyalty. If you’re looking to start accepting credit cards, TCM is here to help.

Get the best credit card processing for accountants

- Lowest-cost processing in the industry

- Fund transfers in less than one day

- A full set of payment products to accept payment anytime, anywhere

- World-class customer service