In the world of credit card processing, chargebacks are an inevitable reality that businesses must deal with. While chargebacks serve as a valuable consumer protection mechanism, they can have significant implications for businesses.

To gain a deeper understanding of the impact of chargebacks, it is essential to explore chargeback statistics in credit card processing. By examining the numbers and underlying factors, businesses can better equip themselves to mitigate risk, enhance customer satisfaction, and optimize their payment processing.

In this article, we dive into chargeback statistics and key metrics on common reasons for chargebacks, chargeback rates by industry, and chargeback rates by country.

What is a chargeback?

A chargeback is a transaction reversal process initiated by a credit card holder through their credit card issuer. It allows consumers to dispute a transaction and request a refund for various reasons, such as fraud, unauthorized charges, or dissatisfaction with goods or services received. When a chargeback is initiated, the cardholder’s funds are returned to their account, and the disputed amount is deducted from the merchant’s account.

The chargeback process involves several parties, including the cardholder, the issuing bank (the cardholder’s bank), the acquiring bank (the merchant’s bank), and the payment network (such as Visa, Mastercard, or American Express) that facilitates the transaction. The cardholder typically contacts their issuing bank to report the issue and initiates the chargeback process. The issuing bank investigates the claim and determines its validity based on the provided evidence and relevant card network rules.

Once the chargeback is initiated, the merchant is notified and given an opportunity to respond to the dispute. The merchant can provide evidence to challenge the chargeback, such as proof of delivery or documentation showing that the transaction was valid. The acquiring bank reviews the merchant’s response and submits the necessary documentation to the issuing bank for further review.

Ultimately, the issuing bank makes the final decision on whether to accept the chargeback. If the chargeback is accepted, the disputed amount is returned to the cardholder and the merchant also incurs additional fees, normally $25 per chargeback. If the chargeback is rejected, the funds remain with the merchant and the cardholder may have the option to escalate the dispute further. Across all merchants that dispute a chargeback, roughly 20% of the time they win the dispute.

The purpose of chargebacks? Why have them?

Chargebacks exist as a consumer protection mechanism designed to safeguard individuals from fraudulent transactions, unauthorized charges, and unsatisfactory goods or services.

Chargebacks offer a level of consumer confidence, allowing customers to feel secure in their credit card transactions and providing a safety net against potential fraudulent activity or merchant misconduct. The main scenarios that chargebacks protect consumers from are as follows:

Fraudulent Transactions: Chargebacks serve as a defense against fraudulent activity. If a cardholder notices unauthorized charges on their statement, they can initiate a chargeback to dispute the transaction and receive a refund. This helps protect consumers from financial losses resulting from stolen card information or identity theft.

Disputed Transactions: Chargebacks provide recourse for customers who are dissatisfied with the goods or services they received. If a customer believes that the product was misrepresented, or didn’t meet their expectations, they can initiate a chargeback. This encourages merchants to uphold their end of the transaction.

Merchant Misconduct: In cases where a merchant engages in unethical practices, chargebacks act as a mechanism to hold them accountable. If a merchant engages in deceptive advertising, fails to deliver the promised goods or services, or engages in unfair business practices, customers can initiate chargebacks.

In the end, chargebacks protect consumers and give them more reasons to own and use credit cards. While chargebacks offer consumer protection, they can also have significant consequences for merchants. Excessive chargebacks lead to financial losses, increased payment processing fees, and potential restrictions imposed by payment processors.

Most common reasons for chargebacks

Understanding why chargebacks happen is crucial for merchants to effectively manage and reduce their occurrence. Chargebacks can result from fraudulent transactions, dissatisfaction with products or services, non-delivery or late delivery, billing errors, subscription issues, technical or processing errors, identity theft, and misunderstandings or lack of communication. By examining the common causes of chargebacks, merchants can implement strategies to prevent them, improve customer satisfaction, and maintain a healthy payment environment. In this section, we cover the most common reasons for chargebacks.

One of the leading causes of chargebacks is fraudulent activity which results in 34% of all chargebacks being caused by fraud. This occurs when unauthorized individuals use credit card information or engage in identity theft to make fraudulent purchases. Here is an article on the different types of fraud if you want to research further. Customers who discover these unauthorized charges on their statements may initiate chargebacks to reclaim their funds. Fraudulent chargebacks pose significant challenges for merchants, as they not only lose revenue but may also face penalties.

Problems with the product are another main reason for chargebacks. Customers may dispute charges if they are dissatisfied with the quality, condition, or performance of a product or service they received. Around 6% of the reasons for chargebacks is that the product did not meet their expectations. This could be due to misleading descriptions, damaged goods, poor customer service, or unmet expectations.

Table: Most Common Chargeback Reasons

| Chargeback Reason | Frequency |

|---|---|

| Unknown or Fraudulent Purchase | 34% |

| Product Never Arrived | 26% |

| Wrong Product | 15% |

| Doesn't Meet Expectations | 6% |

| Product Doesn't Fit Description | 5% |

| I've Been Billed Twice | 3% |

The second most common reason for chargebacks is that the product simply did not arrive. Product that do not arrive account for 26% of all chargebacks.

Chargebacks can also occur when customers identify billing mistakes, such as incorrect amounts charged, double charges, or discrepancies between the agreed-upon price and the amount billed. Customers may also dispute transactions if they were charged for items they did not purchase.

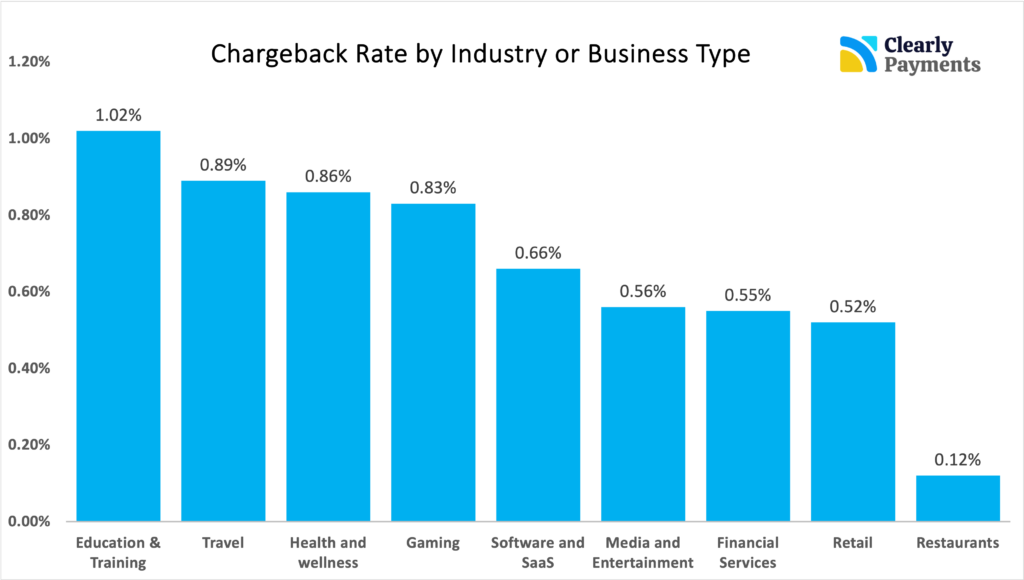

Chargeback rate by industry

The chargeback rate can vary significantly across different industries. Several factors contribute to these differences, including the nature of the products or services offered, the customer demographics, and the specific risks associated with each industry.

The average chargeback rate is 0.60% across all industries. This means 6 out of every 1000 transactions will be a chargeback.

Across all industries, the average chargeback to transaction ratio is 0.60%. That rate means 6 out of every 1000 transactions is a chargeback. In general, the more chargebacks an industry has, the more risky it is perceived by banks.

Merchants who sell physical goods tend to have a chargeback ratio at or below 0.6%. Merchants that sell services, time, or digital goods tend to have higher chargeback rates above 0.6%.

A 1% chargeback rate is the generally accepted maximum, which means you have one chargeback per 100 successful transactions. 1% is usually the maximum allowed for merchant accounts. When above that, you’re dealing with very high payment processing fees and other special circumstances such as funding reserves.

A 1% chargeback rate is generally the highest rate a business can have without restrictions, reserves, or increased pricing from payment processors.

Certain industries have higher chargeback rates due to the nature of the business. As an example, the travel industry, including airlines, hotels, and travel agencies, often experiences higher chargeback rates of 0.89%. This can be attributed to factors such as cancellations, trip disruptions, or dissatisfaction with accommodations.

Table: Chargeback Rate by Industry

| Industry | Chargeback Rate |

|---|---|

| Education & Training | 1.02% |

| Travel | 0.89% |

| Health and wellness | 0.86% |

| Gaming | 0.83% |

| Software and SaaS | 0.66% |

| Media and Entertainment | 0.56% |

| Financial Services | 0.55% |

| Retail | 0.52% |

| Restaurants | 0.12% |

Card-present transactions occur when the cardholder is physically present at the point of sale (POS), such as in-store purchases or transactions conducted using chip-enabled cards. These transactions have much lower chargeback rates compared to card-not-present transactions which are transactions like online or phone orders.

The reason for the difference in chargeback rates is that the physical presence of the credit card and the cardholder provides an extra layer of verification and reduces the likelihood of fraud or disputes arising from unauthorized usage.

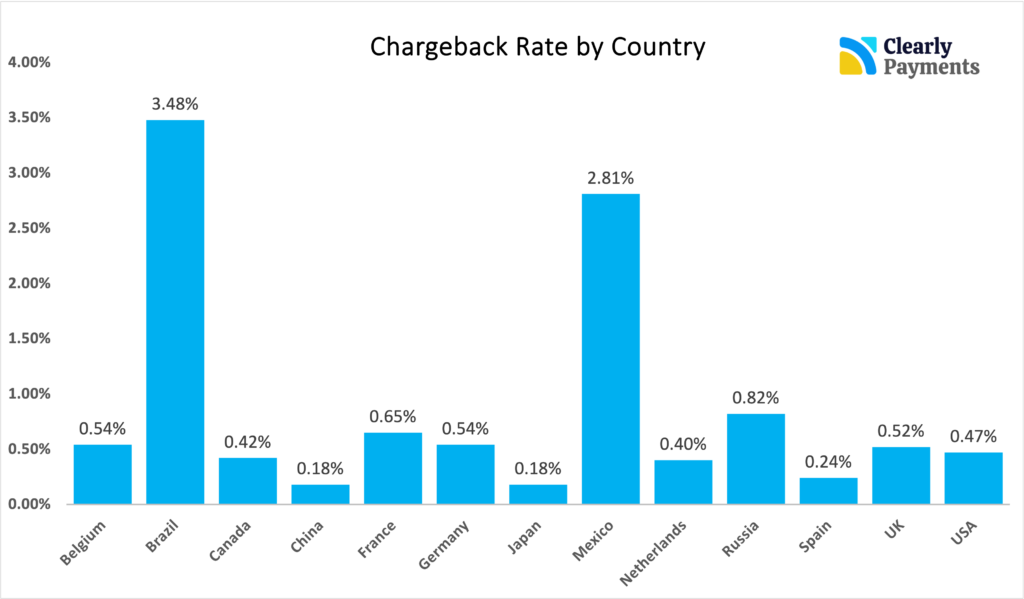

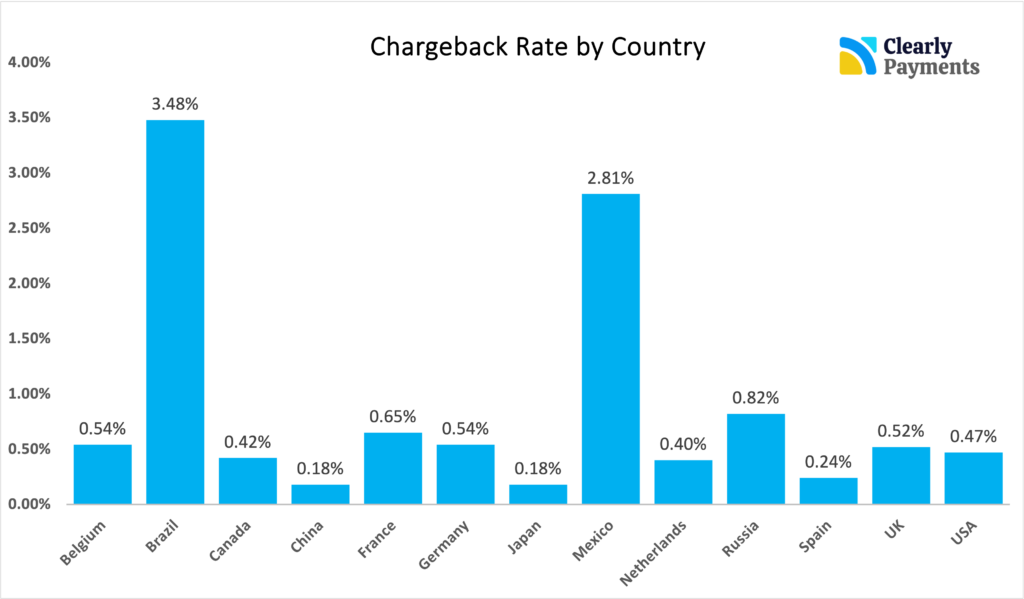

Chargeback rate by country

Chargeback rates differ by country due to several factors. Consumer behavior plays a significant role, as cultural norms and spending habits can vary from one country to another. Countries with a higher propensity for online shopping or stronger consumer rights awareness may experience higher chargeback rates.

Payment regulations also contribute to variations in chargeback rates, as each country has its own set of laws governing chargebacks and consumer protection. The effectiveness of fraud prevention measures, such as advanced fraud detection technologies and identity verification protocols, can impact chargeback rates as well.

The maturity and efficiency of a country’s payment infrastructure also play a role. Well-developed payment systems, secure payment gateways, and standardized dispute resolution processes can lead to lower chargeback rates.

Economic factors, including income levels and financial stability, can influence chargeback rates, with stronger economies potentially experiencing lower rates due to reduced financial pressures on consumers.

The composition of industries within a country can influence chargeback rates. Industries such as travel and online retail, which are more prone to chargebacks due to transaction value or customer dissatisfaction, can impact overall chargeback rates in a country.

It’s important to note that chargeback rates are influenced by a combination of these factors and can change over time as regulations, consumer behaviors, and fraud trends evolve.

From the chart, it is noticeable that Brazil has a very high chargeback rate sitting at 3.48%. Brazil has higher chargeback rates compared to most countries due to several factors. The complex tax system and economic instability have led to higher costs for businesses and financial pressures on consumers. These chargebacks are primarily associated with fraudulent transactions with Brazil ranking highest globally for credit card fraud. Furthermore, compared to other countries, the process of filing a chargeback in Brazil is relatively straightforward, making it easier for consumers to request them. As a result of the elevated fraud rate and the simplified chargeback process, Brazil has high chargeback rates.

Canada and the USA have relatively low chargeback rates, 0.42% and 0.47% respectively, compared to other countries due to factors such as strong financial infrastructure, secure payment technologies, consumer awareness and education, stringent merchant practices, and effective dispute resolution mechanisms. The adoption of secure payment technologies, such as EMV chip cards, and consumer awareness about dispute resolution channels also contribute to lower chargeback rates. Additionally, strict merchant practices and effective mediation mechanisms further promote fair resolutions, reducing the need for chargebacks as the primary means of customer recourse.

Table: Chargeback Rate by Country

| Country | Chargeback Rate |

|---|---|

| Belgium | 0.54% |

| Brazil | 3.48% |

| Canada | 0.42% |

| China | 0.18% |

| France | 0.65% |

| Germany | 0.54% |

| Japan | 0.18% |

| Mexico | 2.81% |

| Netherlands | 0.40% |

| Russia | 0.82% |

| Spain | 0.24% |

| UK | 0.52% |

| USA | 0.47% |

How merchants can reduce chargebacks

Merchants can employ several strategies to reduce the occurrence of chargebacks and mitigate their impact on their business. Here are some effective practices to help merchants minimize chargebacks:

Clear Communication and Transparent Policies: Ensure that your customers have access to clear and concise information about your products, services, refund policies, shipping times, and customer support channels. Clearly communicate terms and conditions, return policies, and any potential fees associated with cancellations or refunds. Transparent and easily accessible information can help prevent misunderstandings and disputes.

Provide Excellent Customer Service: Promptly respond to customer inquiries, concerns, and complaints. Establish a reliable customer support system, such as a dedicated email address or phone line, to address customer issues promptly. By offering exceptional customer service, you can resolve disputes before they escalate to chargebacks.

Accurate Product Descriptions and Images: Ensure that product descriptions and images accurately represent the items you are selling. Misleading or deceptive representations can lead to customer dissatisfaction and chargeback requests. Provide detailed and accurate information to set proper expectations for customers.

Secure Payment Processing: Implement robust security measures to protect customer data and prevent fraudulent transactions. Utilize secure payment gateways and follow industry best practices, such as PCI DSS compliance. The more secure your payment processes, the lower the risk of fraudulent chargebacks.

Order Verification and Address Verification: Verify customer information, including billing addresses and shipping addresses, to minimize the risk of fraudulent transactions. Employ address verification systems (AVS) to ensure that the billing address provided matches the address associated with the credit card.

Clear Billing Descriptors: Use clear and recognizable billing descriptors on customers’ credit card statements. Customers may initiate chargebacks if they don’t recognize the charge on their statement. A recognizable billing descriptor can help reduce confusion and prevent unnecessary disputes.

Prompt Order Fulfillment and Shipping: Process orders promptly and provide customers with tracking information for shipped items. Timely order fulfillment and transparent shipping updates can help reduce customer anxiety and prevent chargebacks resulting from delayed or undelivered items.

Dispute Resolution and Refund Policy: Establish an efficient process for handling customer disputes and offering refunds. Provide customers with an easy and accessible way to contact your support team to address concerns. Resolving disputes directly with customers can prevent chargebacks from being initiated.

Monitor and Analyze Chargeback Data: Regularly review and analyze chargeback data to identify trends, root causes, and areas for improvement. Understanding the reasons behind chargebacks can help you implement targeted strategies to reduce their occurrence.

Fraud Prevention Tools: Employ fraud prevention tools and services, such as address verification systems, CVV verification, and fraud scoring systems. These tools help identify potentially fraudulent transactions and reduce the risk of chargebacks resulting from fraudulent activity.

By implementing these practices, merchants can significantly reduce chargebacks, enhance customer satisfaction, and maintain a healthy payment processing environment. It is important to monitor chargeback ratios and continuously adapt strategies to evolving industry trends and customer expectations.