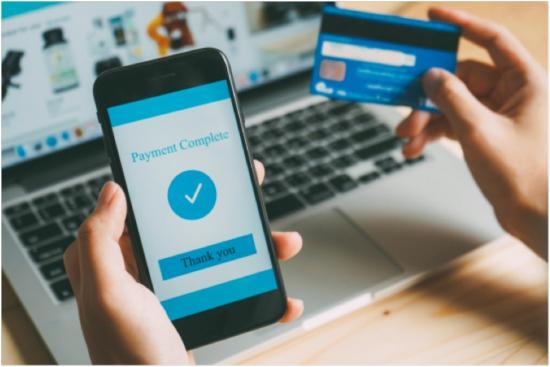

We’ve been working on our “best of” series for payment processing, such as the best credit card machines and best payment processors. In this article, we’ll focus on the best payment gateway for online payments.

Online payments have been growing incredibly over the past 10 years. Website and mobile technology is user friendly, shipping logistics is becoming streamlined, internet connectivity is pervasive, and online payment processing is easy to implement. Many businesses are now incorporating online payments into their business model in one way or another.

We’re going to define a payment gateway as any software platform that allows you to take credit card payments on your website or mobile app. This guide is intended to help you choose the best payment gateway for online payment processing for your business.

How to choose the best payment gateway

Not too long ago, there was not much choice for a payment gateway. With the growth of eCommerce, new payment gateways have come to market. Today, there are many options. When it comes down to it, there are a handful of things you should consider in choosing your payment gateway. We cover these considerations below.

Integrations with shopping carts and platforms

Software needs to work seamlessly with the other systems you use. Your payment gateway takes the payments, either one-time payments or recurring payments. However, there are other systems involved.

For example, your website may be built with WordPress, which means the payment gateway needs to integrate seamlessly. Possibly you want your system to connect to QuickBooks for your accounting.

Integrations are a critical element of choosing your payment gateway. Some of the most common payment integrations you’ll want to consider include:

-

Accounting systems

Accounting software like QuickBooks, Xero, or NetSuite help keep financials organized

-

Shopping carts

Shopping carts like WooCommerce, 3dcart, CubeCart help with the checkout process

-

eCommerce platforms

You may use WordPress, Drupal, Shopify, Wix or some other online shopping platform

-

Recurring billing

Recurring billing systems like Fusebill and Chargebee manages scheduled payments

-

Retail and Point-of-Sale

Point-of-sale (POS) systems like NCR, Tender Retail, or Squirrel help manage checkouts

-

Credit card machines

Payment terminals such as Ingenico or Verifone might need to be integrated

Developer friendliness in your payment gateway

A key benefit of a payment gateway is the ability for a web developer to work with it. Rarely will there be a fully plug-and-play solution because every website is different. Developer friendliness means simple coding (elegant), clear error handling, great documentation, a complete feature set, and sample code.

Sometimes this is difficult for a manager to investigate developer friendliness because it is inherently technical. You may need support with this part of the analysis. Talk to your developer. If you don’t have one and want help, we will provide full support along the way to make sure your online payments gets up and running.

Currency support in online payments

Different currencies are not needed for all online businesses. Sometimes your customers are always in a single country. However, one of the benefits of online payments is the ability to have customers anywhere in the world. This brings the need to consider the currency that you offer your products to customers.

If you only want to offer one currency, things are simple. The next most popular case is the need for two currencies: USD and CAD for American and Canadian buyers. You’ll want to make sure your online payment gateway supports those currencies.

Now, if you’re going fully global, you may want to support many currencies. Globally, there are 180 currencies, but it is unlikely that you’ll need that. However, if you need support for several currencies, there is the ability to offer any currency to your customers with DCC or Dynamic Currency Conversion. In this case, you’ll want to make sure your gateway offers dynamic currencies.

Getting your online payments funds reliably

One of the most important factors is how fast you get your money. Cash flow is an advantage for any business. To get to the answer quickly, if you are processing a lot ($500k+ per year), definitely get a merchant account and choose a separate payment gateway. This is a best-of-breed strategy. Since you’re doing hundreds of thousands of dollars or even tens of millions, it’s time to get a solution that is built for your business. Get a merchant account. Your funds will get directed into your bank account faster with much less risk of funds being held for days and sometimes weeks.

If you are processing less, especially if it is below $100k per year, your likely best solution is an aggregated merchant account. This means a merchant account shared with other businesses. This means using a company like PayPal or Stripe. Even though you pay higher percentage fees (such as 2.9%), you pay lower monthly fees. It is more economical for a merchant to use PayPal or Stipe if you’re processing below $100k per year. There is more risk with funds being held. That is the downside. Do a google search on “paypal funds being held” and you’ll understand the risk.

Fees for online payments

Fees for online payments vary widely. There are several different pricing methodologies that payment gateways and online payment processors use. There are four main categories for fees listed below. There are other fees that play a smaller amount of the total cost, but these are quite frequently baked into the pricing.

- Interchange fees: these are the fees that are set by Visa and MasterCard. They are a non-negotiable cost for all businesses.

- Processor markup: these are the fees that payment processors charge on top of interchange to run their business.

- Transaction fees: these are the flat dollar amounts per transaction, generally $0.05 to $0.30 per transaction.

- Monthly fees: these are the flat monthly charges for using the payment gateway, generally $10 to $25 per month.

If you are processing more that $100,000 per year, it’s time to get a merchant account. You’ll end up paying lower cost, you’ll have faster and more reliable funding, and you’ll get a better level of customer service. The overall rate you’ll end up paying might be around 2.2% and $0.10 per transaction. At a high processing level, that’s a lot of savings for your online payment processing. What’s unfortunate is that most merchants are actually paying more, such as 3% to 6%. That’s why TCM has the mission to drive down the cost of payment processing.

Getting customer support for your payment gateway

Payment systems are mission critical for your business. If you can’t get paid, you lose customers. Choose a payment gateway provider that has 24/7 support that you can access by chat, email, and phone. Most payment aggregators (i.e. Stripe, PayPal, etc) don’t have fully accessible support because they deal with thousands of customers on each merchant account. It becomes too costly for them to provide 24/7 support to all customers.

Merchant account providers generally have better support, but you need to verify the support levels because they range widely. Test out their email support and phone support line. It’s easy to test the level of service you will get with their response times.

The best payment gateways for online payments

Choosing the best payment gateways for online payments is critical for your business. The best might differ somewhat for the type and size of business you run. Here are the list of top payment gateways along with some of the benefits and what to look out for.

Payment Gateway

Benefits and things to watch out for

- Likely the lowest pricing you can get for payment processing

- Great documentation and technology used by millions of businesses across USA and Canada

- Technology sourced by top global payment companies

- You get a merchant account that accepts any credit card globally

- Generally not the best for merchants processing less than $100,000 per year

- Best for merchants processing more than $100,000 per year

- Fast to get started with minimal signup steps

- Great documentation for developers

- Focused on developers with a deep set of API functionality

- You’re paying 2.9% and $0.30 per transaction

- Low fees if processing less than $100,000 per year

- Fees are high if processing more than $100,000 per year

- Typical for an aggregator, complaints exist that funds are sometimes held

- Fast to get started

- Easily accepts PayPal from customers if your customers tend to use PayPal

- One of the most popular payment gateways

- Fees can be quite high with PayPal

- You’re paying 2.9% and $0.30 per transaction plus $35 per month as a monthly fee

- Typical for an aggregator, complaints exist that funds are sometimes held

- A very scalable gateway used by millions of merchants

- Likely not the best for small merchants processing below $100,000 per year due to the $25 monthly fees

- There have been some reviews with less than stellar customer support ratings

- You’re paying 2.9% and $0.30 per transaction or $25 per month as a monthly fee for the gateway only

- Authorize.net works with TCM so you can easily get low cost payment processing

- Likely not the best for small merchants processing below $100,000 per year due to the $25 monthly fees

- A plus is that Bambora supports bank to bank transfers (EFT and ACH)

- Bambora has had reviews where it has been difficult to get a hold of customer support

- Bambora works with TCM so you can easily get low cost payment processing