A virtual terminal is a web-based tool that allows businesses to process credit and debit card payments remotely. It is a software (aka virtual) alternative to physical card terminals commonly found in brick-and-mortar stores. With a virtual terminal, businesses can accept payments from customers without the need for face-to-face interactions or the use of physical card-reading devices.

Using a virtual terminal, businesses can manually enter payment information, such as the customer’s card number, expiration date, CVV (Card Verification Value) code, and billing address, into an online interface. This information is securely transmitted to a payment gateway, which then communicates with the payment processor and the customer’s bank to authorize and process the payment.

Virtual terminals are particularly useful for businesses that operate online, conduct phone or mail order transactions, or provide services remotely. However, they are also popular for in-person transactions. They offer flexibility and convenience by enabling businesses to accept payments from customers wherever they are located, as long as there is an internet connection.

How a virtual terminal works

A virtual terminal is a web-based payment processing solution that allows businesses to accept credit and debit card payments remotely.

Here’s an overview of how a virtual terminal transaction typically works:

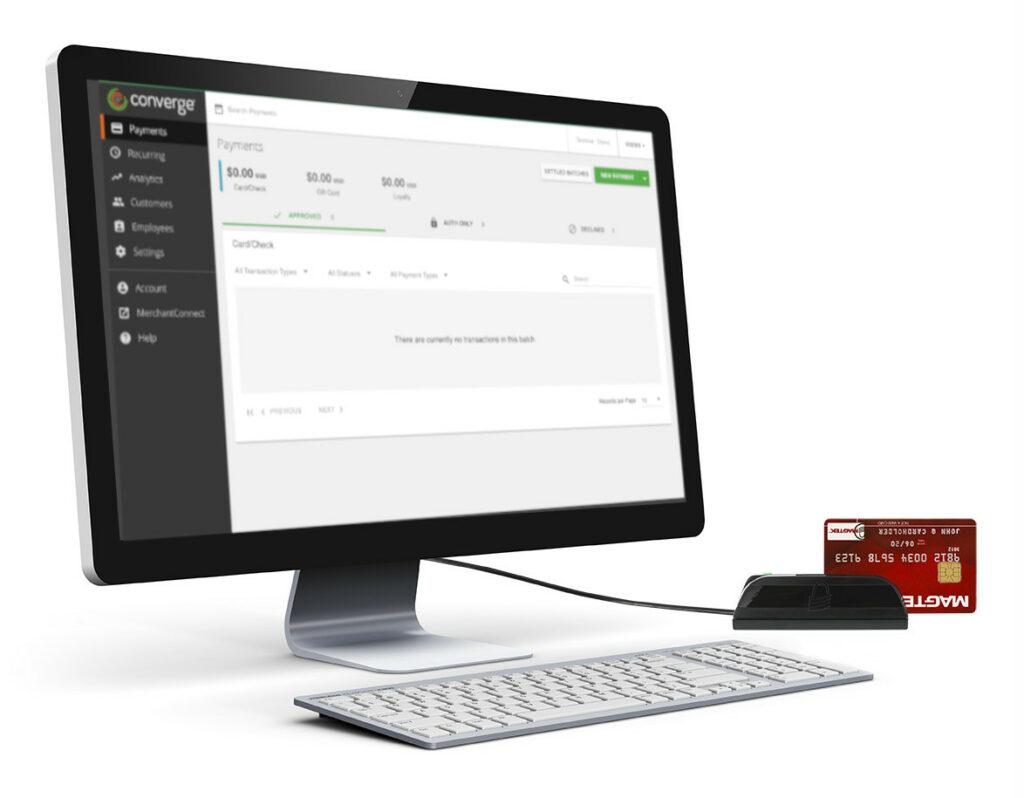

Secure Login: Businesses access the virtual terminal through a secure login on a web browser or a designated software application. This login provides them with access to the virtual terminal’s interface.

Payment Entry: Once logged in, businesses enter the customer’s payment information manually into the virtual terminal. This includes the cardholder’s name, card number, expiration date, CVV (Card Verification Value) code, and billing address. Some virtual terminals also support the scanning of card information using a card reader or mobile device camera for faster data entry.

Authorization: Once the payment information is entered, the virtual terminal securely sends the transaction details to the acquiring bank for authorization. The payment processor communicates with the card issuer to verify the transaction and determine whether the card has sufficient funds or credit limit.

Approval or Decline: The payment processor or acquiring bank returns an authorization response to the virtual terminal, indicating whether the transaction is approved or declined. If approved, the virtual terminal displays a confirmation to the merchant and initiates the settlement process.

Settlement: After receiving the authorization, the virtual terminal securely submits the transaction for settlement. The settlement process involves transferring the funds from the customer’s bank account to the merchant’s account. Settlement usually occurs within a specified timeframe, typically a few business days.

Receipt Generation: Upon successful settlement, the virtual terminal can generate a digital receipt, which can be emailed to the customer or printed for record-keeping purposes. The receipt includes transaction details, such as the amount, date, and merchant information.

It’s important to note that virtual terminals prioritize security and employ encryption protocols to protect sensitive payment information. They adhere to industry standards, such as PCI DSS (Payment Card Industry Data Security Standard), to ensure the safe handling of cardholder data.

Virtual terminal benefits for businesses

Virtual terminals offer several advantages that make them a popular choice for businesses. Here are some key reasons why virtual terminals are considered beneficial:

Accessibility and Convenience: Virtual terminals enable businesses to accept payments from customers anytime and anywhere, as long as they have an internet connection. This accessibility allows businesses to reach a broader customer base and offer their products or services globally without the limitations of physical terminals or in-person transactions.

Payment Flexibility: Virtual terminals support various payment methods, including credit and debit cards, allowing businesses to cater to customers’ preferences. They can process payments from customers over the phone, through email, or via online invoicing. This flexibility increases customer convenience and satisfaction, leading to improved sales and customer retention.

Reduced Costs: Virtual terminals eliminate the need for dedicated hardware or physical card terminals, which can be costly to purchase or lease. Businesses can save on equipment expenses, maintenance costs, and related fees. Additionally, virtual terminals streamline payment processes, reducing administrative time and effort associated with manual entry or paperwork.

Enhanced Security: Virtual terminals prioritize security measures to protect sensitive customer payment information. They use encryption and secure data transmission protocols, ensuring the confidentiality and integrity of payment data. By reducing the risks of data breaches or fraudulent activities, businesses can build trust with customers and mitigate potential financial losses.

Streamlined Operations: Virtual terminals integrate with other business systems, such as accounting or customer relationship management (CRM) software, automating payment processing and reconciliations. This integration eliminates manual data entry, reduces errors, and streamlines financial operations. It also enables businesses to generate reports and gain insights into their sales and revenue streams.

Scalability and Growth Potential: Virtual terminals accommodate businesses of all sizes, from startups to established enterprises. They offer scalability, allowing businesses to handle an increasing volume of transactions as they grow. Virtual terminals can adapt to changing business needs and support expansion into new markets or sales channels.

Customer Service and Experience: Virtual terminals facilitate quick and efficient payment processing, enhancing the overall customer experience. They reduce checkout friction, leading to smoother transactions and improved customer satisfaction. Businesses can provide personalized service by securely storing customer payment information for repeat purchases or recurring billing.

Overall, virtual terminals provide businesses with a convenient, cost-effective, and secure payment processing solution. By embracing virtual terminals, businesses can streamline operations, expand their reach, and deliver exceptional customer experiences, ultimately contributing to their growth and success in the digital age.

The disadvantages of a virtual terminal

While virtual terminals offer numerous advantages, there are also some disadvantages to consider. These include:

Card-Not-Present (CNP) Risks: Virtual terminals typically involve card-not-present transactions, where the merchant does not physically verify the card or the cardholder. This presents a higher risk of fraudulent activities compared to face-to-face transactions. Merchants must implement robust security measures to mitigate the risks associated with CNP transactions, such as identity verification and fraud detection systems.

Manual Entry Errors: Virtual terminals generally use manual entry of payment information, which introduces the possibility of human errors. Entering incorrect card numbers, expiry dates, or CVV codes can lead to declined transactions or payment discrepancies. Merchants must exercise caution and implement measures, such as double-checking entries or using card readers, to minimize errors during data entry.

Limited Payment Method Options: Virtual terminals primarily focus on credit card payments. However, some customers may prefer alternative payment methods, such as digital wallets, debit cards, or bank transfers. Virtual terminals may not support these options, limiting the flexibility for customers and potentially impacting conversion rates.

Higher Processing Fees: Virtual terminals often incur higher processing fees compared to physical card terminals. The pricing structure may include additional fees for CNP transactions or higher transaction rates due to increased fraud risk. Virtual terminals generally have the same fees as online transactions.

While the disadvantages exist, many businesses find that the benefits of virtual terminals outweigh the drawbacks. By addressing the security concerns, implementing proper safeguards, and selecting reliable virtual terminal providers like TCM, businesses can maximize the advantages while minimizing the potential disadvantages associated with virtual terminals.

What businesses use virtual terminals

While virtual terminals can be utilized by a wide range of businesses, certain industries and business types find them particularly beneficial. Here are a few examples of businesses that commonly use virtual terminals:

Online Retailer and eCommerce: Virtual terminals are popular among e-commerce businesses and online retailers who sell products or services over the internet. They enable these businesses to securely process credit card payments from customers without the need for physical card terminals or manual entry of payment details.

Mail Order/Telephone Order (MOTO) Businesses: MOTO businesses, which primarily operate through mail or phone orders, also benefit from virtual terminals. By entering customer payment information into the virtual terminal, they can securely process payments remotely, making it convenient for customers who prefer not to provide payment details online.

Professional Services: Various professional service providers such as consultants, lawyers, accountants, and freelancers often rely on virtual terminals to accept payments from clients. Virtual terminals allow them to send invoices electronically and receive payments securely, improving cash flow and reducing administrative burdens.

Non-profit Organizations: Non-profit organizations, including charities and foundations, often utilize virtual terminals to collect donations and process payments. Virtual terminals provide an efficient and secure way for donors to contribute online or over the phone, making it easier to support the organization’s cause.

Hospitality and Event Management: Businesses in the hospitality industry, such as hotels, resorts, and event planners, can leverage virtual terminals for accepting payments from guests or event attendees. Whether it’s pre-authorizing credit cards for reservations or processing payments for services rendered, virtual terminals streamline the payment process in a convenient and secure manner.

Subscription-based Services: Businesses offering subscription-based services, such as streaming platforms, membership clubs, or software-as-a-service providers, often rely on virtual terminals. They allow these businesses to automate recurring payments, manage subscription renewals, and ensure a seamless payment experience for their customers.

It’s important to note that these are just a few examples, and virtual terminals can be used by businesses across various industries. Any business that needs to accept remote payments, process credit cards, or facilitate online transactions can benefit from the convenience, flexibility, and security offered by virtual terminals.

How to get a virtual terminal?

A virtual terminal offers convenience, flexibility, security, cost-effectiveness, and ease of use for businesses that accept payments. As more businesses seek to expand their payment options, virtual terminals are likely to become increasingly popular in the payments industry. TCM will help you every step of the way to get up and running with a virtual terminal. Reach out to TCM today.

Accept credit cards with a virtual terminal from TCM

- Lowest-cost processing in the industry

- Fund transfers in less than one day

- A full set of payment products to accept payment anytime, anywhere

- World-class customer service